Is Forex Trading Gambling Reddit

- Is Forex Trading Gambling Reddit Sites

- Is Forex Trading Gambling Reddit Stocks

- Is Forex Trading Gambling Reddit Yahoo

- Is Forex Trading Gambling Reddit Money

Why do you trade forex?

The relationship between Forex trading, or any trading at all, and gambling is one that we professionals are asked to address regularly. I get this question quite often socially. I live a somewhat social life, and have many friends that I dine with regularly. Forex trading is glorified gambling. Forex traders are basically the same as a gambling addict down at the bookies, they sit and watch a screen all day to guess if the movement is up or down with a little bit of 'analysis' here and there, similar to picking out the best horse in a race.

Let me guess…

Because you want to make a ton of money and be able to buy anything you wish?

While this is a perfectly valid reason, it will most likely lead to excessive greed and ultimately lead to your trading account’s destruction. You might as well take your money to Vegas and gamble it away instead. Once your money is all gone, at least it was entertaining.

Greed is the worst motivation for trading. The market will always punish greed and will always reward moderation.

There is a fine line between traders and gamblers. When there is real money on the line, there are always those who take blind chances.

If you want to be consistently profitable, do NOT think like a gambler, do NOT take blind chances and do NOT solely rely on luck. Remember that luck comes and goes just like the gambler.

As a trader, you must realize that anything can happen in the markets. Without accepting this very essential fact, you will NEVER become consistently profitable.

I know, I know, the idea just sounds silly! How can you, as a trader, become consistently profitable from a market that has uncertain outcomes? It’s just not possible!

WRONG! In trading and in life, we have what are called PROBABILITIES.

Casinos are profitable year, after year, after year, despite having a business where the outcome of each card laid down, dice roll, or slot pull is unknown each and every time.

They understand the concept of probabilities and create games that put the odds in their favor–in other words, “the house advantage.”

While it is true that there will be some lucky ones that will win and walk away with millions of dollars, casinos know that if they get a large enough sample size, there will be more losing patrons than winners in the end.

Let’s take baccarat, a popular card game for high rollers, for example. The game is fairly simple. Cards are dealt to a “banker” and a “player,” and all you have to do is place a bet on either one.

Since you have equal access to both the banker and the player (you can even bet on a TIE if you want), it would seem like you essentially have a 50% chance of winning. But in reality, that’s not the case.

By tweaking the rules, like charging a very small commission or reducing the payout if the banker wins with a certain number, the odds are turned slightly in favor of the house. It might be a very tiny advantage, anywhere from 1% to 5%, but it’s enough for the house to eventually come out on top when enough games are played.

You have to remember that what differentiates trading from gambling is being able to bend the odds in your favor. That is why, as a trader, your mindset should be akin to that of the casino and not the gambler, who merely focuses on one event (or trade) at a time.

To become consistently profitable, you have to trade like the HOUSE and play the advantage over a series of outcomes. How can you do this, you ask? Here are a few tips:

First, you need to learn the market behaviors, patterns, and tendencies that could be recognized in the future and turned into a trading opportunities.

This comes from reviewing price action against a framework (support and resistance, mechanical indicators, economic events, etc.), recording your observations, and then devising statistics to keep track of the different kinds of patterns or setups.

This is also where keeping a trade journal becomes a necessity. Using the data from your journal, you can focus on the setups that have had higher probabilities of winning, rather than those setups that tend to lose.

You’ll also need solid risk management. You can tilt the odds of long term success in your favor even more if you limit yourself to setting up or taking trades that have an attractive risk-management ratio (ie. average bigger wins than losses). The better the reward-to-risk ratio, the less often you need to win a trade.

For instance, if you notice that you are good in spotting double top formations and trading them, then you can devise a trading system that focuses on finding setups based on double top chart patterns.

If you are able take a large enough number of these trades, and your winners are larger than your losers, then you’ll eventually end up profitable over the long run!

Last but not the least, you can look to other traders in addition to your own analysis. The web is loaded with free economic and technical analysis content. By getting a second opinion, you make sure that you don’t fall into the “confirmation bias” trap.

Of course, these aren’t the only ways to tilt the odds in your favor. But you should always remember that you don’t have to predict exactly where the market will go; you just have to figure out where price will likely go and make the best of it if the trade goes your way.

What is forex trading?

How does forex trading work?

In the forex market, you buy or sell currencies.

Placing a trade in the foreign exchange market is simple. The mechanics of a trade are very similar to those found in other financial markets (like the stock market), so if you have any experience in trading, you should be able to pick it up pretty quickly.

And if you don’t, you’ll still be able to pick it up….as long as you finish School of Pipsology, our forex trading course!

The objective of forex trading is to exchange one currency for another in the expectation that the price will change.

More specifically, that the currency you bought will increase in value compared to the one you sold.

Here’s an example:

| Trader’s Action | EUR | USD |

| You purchase 10,000 euros at the EUR/USD exchange rate of 1.1800 | +10,000 | -11,800* |

| Two weeks later, you exchange your 10,000 euros back into U.S. dollar at the exchange rate of 1.2500 | -10,000 | +12,500** |

| You earn a profit of $700 | 0 | +700 |

*EUR 10,000 x 1.18 = US $11,800

** EUR 10,000 x 1.25 = US $12,500

An exchange rate is simply the ratio of one currency valued against another currency.

For example, the USD/CHF exchange rate indicates how many U.S. dollars can purchase one Swiss franc, or how many Swiss francs you need to buy one U.S. dollar.

How to Read a Forex Quote

Currencies are always quoted in pairs, such as GBP/USD or USD/JPY.

The reason they are quoted in pairs is that, in every foreign exchange transaction, you are simultaneously buying one currency and selling another.

How do you know which currency you are buying and which you are selling?

Excellent question! This is where the concepts of base and quote currencies come in…

Base and Quote Currency

Whenever you have an open position in forex trading, you are exchanging one currency for another.

Currencies are quoted in relation to other currencies.

Here is an example of a foreign exchange rate for the British pound versus the U.S. dollar:

The first listed currency to the left of the slash (“/”) is known as the base currency (in this example, the British pound).

The base currency is the reference element for the exchange rate of the currency pair. It always has a value of one.

The second listed currency on the right is called the counter or quote currency (in this example, the U.S. dollar).

When buying, the exchange rate tells you how much you have to pay in units of the quote currency to buy ONE unit of the base currency.

ONE unit of the base currency.In the example above, you have to pay1.21228 U.S. dollars to buy 1 British pound.

When selling, the exchange rate tells you how many units of the quote currency you get for selling ONE unit of the base currency.

In the example above, you will receive1.21228 U.S. dollars when you sell 1 British pound.

The base currency represents how much of the quote currency is needed for you to get one unit of the base currency

If you buy EUR/USD this simply means that you are buying the base currency and simultaneously selling the quote currency.

In caveman talk, “buy EUR, sell USD.”

- You would buy the pair if you believe the base currency will appreciate (gain value) relative to the quote currency.

- You would sell the pair if you think the base currency will depreciate (lose value) relative to the quote currency.

Is Forex Trading Gambling Reddit Sites

With so many currency pairs to trade, how do forex brokers know which currency to list as the base currency and the quote currency?

Fortunately, the way that currency pairs are quoted in the forex market is standardized.

You may have noticed that currencies quoted as a currency pair are usually separated with a slash (“/”) character.

Just know that this is a matter of preference and the slash may be omitted or replaced by a period, a dash, or nothing at all.

For example, some traders may type “EUR/USD” as “EUR-USD” or just “EURUSD”. They all mean the same thang.

“Long” and “Short”

First, you should determine whether you want to buy or sell.

If you want to buy (which actually means buy the base currency and sell the quote currency), you want the base currency to rise in value and then you would sell it back at a higher price.

In trader talk, this is called “going long” or taking a “long position.” Just remember: long = buy.

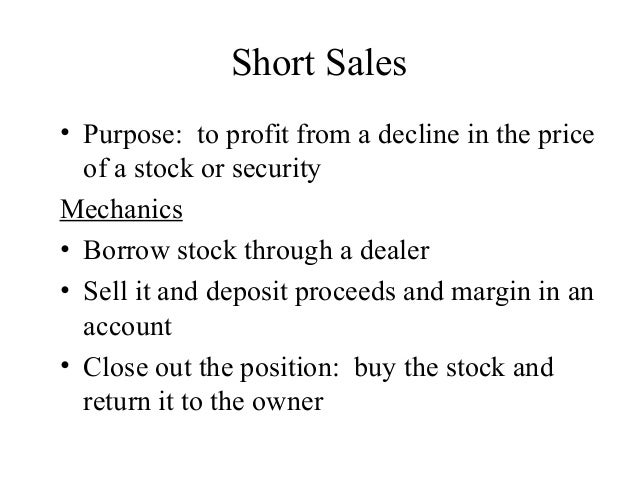

If you want to sell (which actually means sell the base currency and buy the quote currency), you want the base currency to fall in value and then you would buy it back at a lower price.

This is called “going short” or taking a “short position”.

Just remember: short = sell.

Flat or Square

If you have no open position, then you are said to be “flat” or “square”.

Closing a position is also called “squaring up“.

The Bid, Ask and Spread

All forex quotes are quoted with two prices: the bid and ask.

In general, the bid is lower than the ask price.

What is “Bid”?

The bid is the price at which your broker is willing to buy the base currency in exchange for the quote currency.

This means the bid is the best available price at which you (the trader) can sell to the market.

If you want to sell something, the broker will buy it from you at the bid price.

What is “Ask”?

The ask is the price at which your broker will sell the base currency in exchange for the quote currency.

This means the ask price is the best available price at which you can buy from the market.

Another word for ask is the offer price.

If you want to buy something, the broker will sell (or offer) it to you at the ask price.

What is “Spread”?

Is Forex Trading Gambling Reddit Stocks

The difference between the bid and the ask price is known as the SPREAD.

On the EUR/USD quote above, the bid price is 1.34568 and the ask price is 1.34588. Look at how this broker makes it so easy for you to trade away your money.

- If you want to sell EUR, you click “Sell” and you will sell euros at 1.34568.

- If you want to buy EUR, you click “Buy” and you will buy euros at 1.34588.

Is Forex Trading Gambling Reddit Yahoo

Here’s an illustration that puts together everything we’ve covered in this lesson:

Is Forex Trading Gambling Reddit Money

Now let’s take a look at some examples.